Forecasts, Market Expectations & staying prepared

As we approach a new year, the financial world is buzzing with forecasts about where the economy and markets might be headed. These predictions often highlight important considerations, including the forces that could shape the markets in the coming year. While these forecasts are informative and interesting, it is important to remember that they are educated guesses based on today’s information and assumptions about tomorrow. Unfortunately, the reality is that the future rarely unfolds exactly as anyone expects, and thus predictions cannot be relied on. With this in mind, what should you consider instead?

Important Disclosure: This commentary contains forward-looking statements based on current expectations and assumptions. Actual results may differ materially. Forecasts are not guarantees.

Forecasts

What Forecasts Can Tell Us

Every major financial firm releases their 2026 outlook around this time of year, often with forecasts contradicting other firms. The contradicting information can lead to confusion, but also serves as a reminder that markets are volatile and the future is uncertain. While financial forecasts are not usually helpful in predicting the future, they do help highlight the main themes that may influence the markets in the coming year to understand what is worth watching. When reviewing forecasts, we recommend paying attention to the main drivers, to understand the potential impact each driver may have on a variety of outcomes. See some of the key drivers we’re watching in 2026 below.

What Forecasts Cannot Tell Us

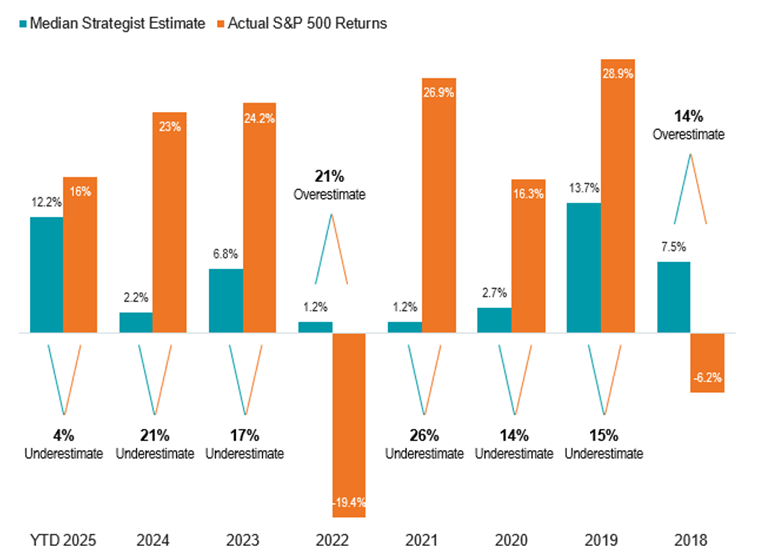

Forecasts are purely predictions that cannot account for information or events that have yet to occur. They do not provide definitive outcomes or foresee surprises, whether positive or negative. History shows that even the most respected forecasts often miss the mark when unexpected developments arise. The below chart shows the consensus Wall Street forecast for S&P 500 performance year-by-year compared to actual performance results. As the graph shoes, predictions and reality can vary widely, thus they should not drive changes to long-term strategy.

Disclosures: Graph by Avantis Investors. Data from 1/1/2018 – 11/30/2025.

Sources: Emily McCormick, “What Wall Street Strategists Forecast for the S&P 500 in 2019,” Yahoo Finance, December 31, 2018; Jeff Sommer, “Clueless About 2020, Wall Street Forecasters Are at It Again for 2021,” New York Times, December 18, 2020; Jeff Sommer, “Forget Stock Predictions for Next Year. Focus on the Next Decade,” New York Times, December 16, 2022; Senad Karaahmetovic, “Top Wall Street Strategists Give Their S&P 500 Forecasts for 2023,” Investing.com, December 27, 2022; Tom Aspray, “Should You Worry That Strategists Keep Raising Their S&P 500 Targets?” Forbes, October 20, 2024. Past performance is no guarantee of future results.

Market Expectations - Key Drivers to Watch in 2026

Instead of offering a prediction for 2026, we instead want to focus on the key drivers we are currently monitoring in relation to our client portfolios and why they each matter.

Interest Rates

Rates affect mortgages, business investment, valuations, and bond returns. If rates move lower, they can support both stocks and bonds. If rates stay higher for longer, it will create a different environment. The key is to be prepared for multiple scenarios, to be able to act quickly should the need arise.

Corporate Earnings

Companies will need to show that they can continue growing profits in a more mature economic cycle. Earnings tend to drive long term stock returns more than headlines do.

Inflation

Inflation has cooled, but remains elevated compared to the levels targeted by the Fed. Whether it remains stable, rises, or falls will influence policy decisions and market expectations throughout the year.

Employment

Recent unemployment figures have reached the highest level in four years and hiring numbers have cooled. If job growth continues to slow, it could be a drag on the economy and market. If hiring numbers improve, we are likely to see an increase in consumer confidence and spending.

Global factors

Geopolitics, supply chains, elections, and unexpected world events can shift market sentiment quickly. These events are impossible to predict. A globally diverse portfolio can help protect against global factors.

Staying Prepared

Preparation means building diversified portfolios that do not rely on one specific outcome. This helps reduce risk and prevent reliance on a single company, sector, or market. It means using evidence-based strategies, including broad diversification, systematic exposure to long-term drivers of return, and disciplined rebalancing. Additionally, it means not overreacting to short-term noise or every news story and instead staying focused on your long-term financial goals. A long-term plan that is built thoughtfully and monitored consistently can work across many different market environments.

For more information on preparing your investment strategy for 2026, check our our recent article: Common Investment-Related Questions Nonprofits Face as they Plan for 2026 – Raffa Investment Advisers | Investment Management for Nonprofits

Conclusion

While you do not need to predict the future to be a successful investor, you do need to understand how to prepare. In other words, how to build portfolios that are resilient, flexible, and aligned with your goals. Working with a financial adviser can help prevent emotion-driven or highly reactive decision making to help focus on understanding the right signals or drivers and their impact.

As you read more and more outlooks and predictions for 2026, remember to take them with a grain of salt. They can be interesting and highlight real trends worth monitoring, but they are also opinions based on a moment of time. Preparation and discipline are what ultimately drive long-term success.

As a fiduciary and investment adviser, our work is not about predicting the future with precision, but preparing your portfolio so that it can handle a wide range of possible outcomes. We have been assisting nonprofits and associations in navigating complex and volatile markets for over 20 years and would be happy to discuss how our team could assist your organization in managing your investment portfolio.

Schedule a complimentary consultation with a Raffa Investment Advisers team member.