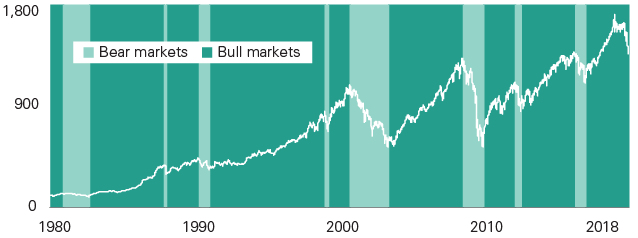

Through the end of September, US equity and fixed income markets have soared returning over 20% and 8.5% respectively[1]. The strong performance comes amidst the backdrop of an inverted yield curve[2], continued U.S.-China trade tensions, and softening global growth. While we can bask in the year to date returns, it’s important to embrace the possibility that the market could experience a sustained downturn due to any one of the above-mentioned issues, or for a reason that is currently unknown. Sustained declines aren’t rare or isolated events as investors are likely to endure many such downturns during their lifetimes. On average over the past 4 decades, investors have experienced one attention-grabbing downturn[3] approximately every two years.

When, and it will be a matter of when, the market dips, reacting by changing long-term investment strategies in response to short term declines could prove more harmful than helpful. In response to the market volatility we experienced in the fourth quarter of last year, Vanguard performed a short exercise to highlight the importance of remaining disciplined through tough times. Please click to download, “Beath the Short-Term Market Jitters”. Instead of looking to strategically time the markets, remain disciplined to your asset allocation targets. By avoiding the urge to sell when the market declines, you can often be better positioned to meet your long-term goals.

[1] Equity is represented by the Russell 3000 Index, Fixed Income is represented by the BBgBarc US Aggregate Bond Index. It is not possible to invest directly in an index. Performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results.

[2] Treasuries with a maturity of a year or less currently have a higher yield than the 10-year Treasury, contrary to a normal upward sloping yield curve

[3] Attention-Grabbing Downturn is defined as a correction or bear market.