Before even beginning to create an effective budget, you need to understand what you are saving towards. Read on to learn more about setting savings goals and prioritizing them.

The 50/30/20 rule is a common approach to saving and spending; spending 50% of your income on necessities, 30% on the things you want, and saving 20%. When deciding where to direct savings, we are often tempted to delay retirement and long-term goals for short term goals. However, pushing retirement savings by even a few years can be detrimental to reaching your long-term goals. For starters, the earlier you begin to save the longer your funds will have to potentially grow. Additionally, for every year you delay savings, you will likely need to save a larger percentage of your income after that to be able to catch up. When planning for your savings goals, you should prioritize promoting retirement savings and then focus on other goals.

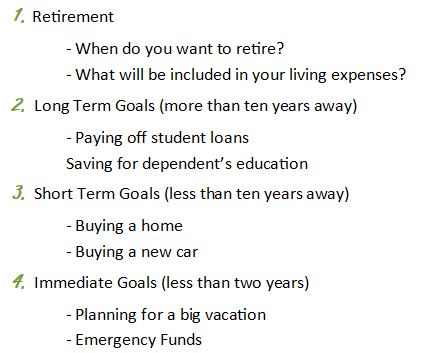

But, before you can prioritize your goals – you need to know what your goals are. You can arrange your goals as they fall into four categories:

Next you will need to think about how flexible your time frame is, and flexibility of the total goal amount. For example, when saving for a dependent’s college expenses your time frame will be set in stone, but the amount that you need to save could be flexible depending on the college, scholarships and other financial support. Alternatively, you may have a hard goal of 20% for a down payment on a house, but since you are waiting for the right house, the date for this goal may be flexible. Understanding the flexibility of your goals will give you a leg up when prioritizing.

Retirement Planning tends to rank very high in terms of importance for many people, as do long term goals, such as saving for dependent college expenses. Fortunately, there are specialty accounts to help save for these goals, such as 401(k) accounts and 529 plans.

Emergency Savings are also often a priority. An emergency fund of around 6 months of expenses can be a challenge to build, but once it is amassed, you will only need to adjust it as expenses change. Emergency savings are important because if you have an emergency, you will want to avoid having to dip into your retirement and/or long-term savings.

Keep track of your progress towards savings goals! Setting a goal and reaching it is a rewarding experience. Plus, as you reach your shorter term goals (emergency funding, vacation plans) you can begin allocating more to those long term goals, perhaps shortening their time horizons!

If you have any questions about budgeting or where to start, please reach out to me directly. John McAuliffe, john@raffawealth.com