The Investment Adviser for your Retirement Plan

Purpose-built retirement plan advisory services to help your employees reach their retirement goals.

End-to-End Retirement Plan Consulting

We provide comprehensive, fiduciary-level guidance for nonprofit retirement plans, from vendor selection to participant education.

Fiduciary Support 3(21) & 3(38)

We act in your best interest as a fiduciary, helping you meet ERISA requirements through investment due diligence, vendor oversight, and participant education.

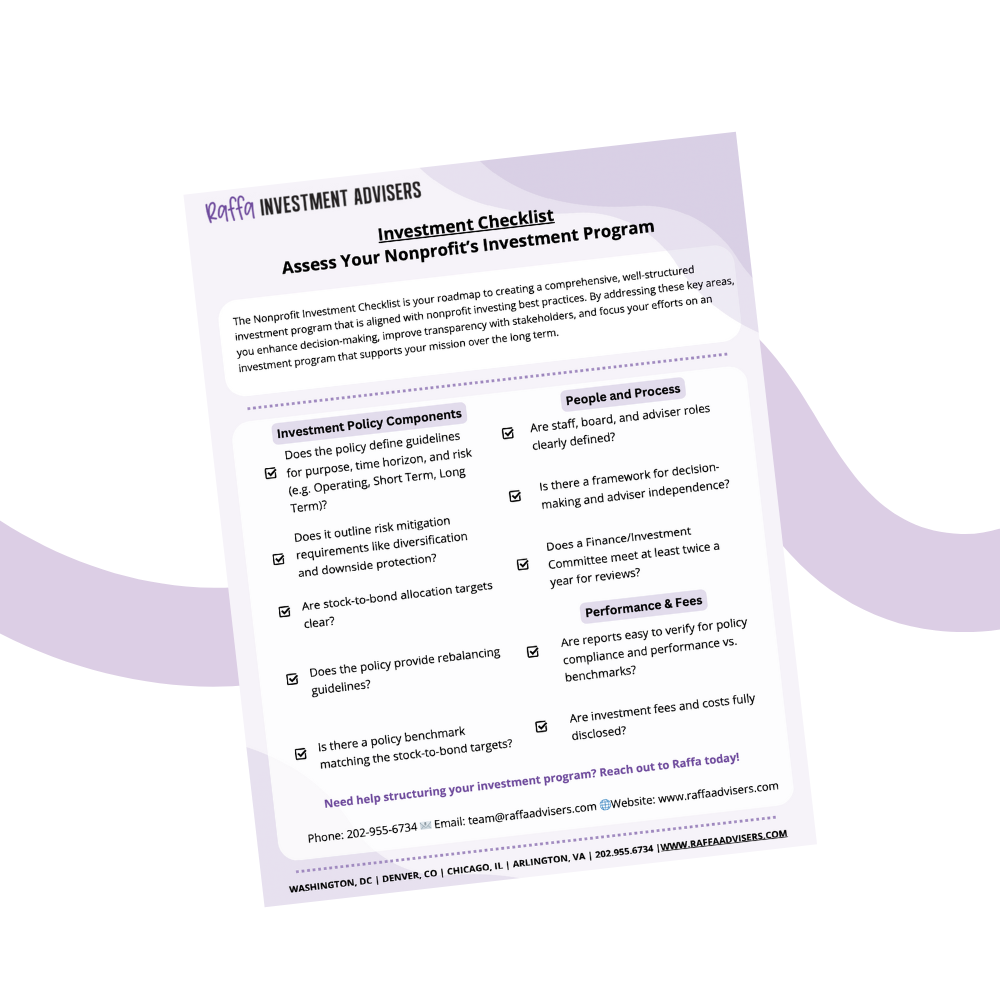

Investment Policy Statement Creation & Review

We draft or revise your investment policy statement that outlines your plan's objectives, constraints, and governance practices—aligned with fiduciary best practices. Learn more about our investment policy services.

Vendor Search & Benchmarking

Our RFP process evaluates and compares recordkeepers and providers to ensure competitive fees, quality service, and participant support.

Investment Selection & Monitoring

Using a proprietary ranking system, we build diversified investment lineups that minimize cost and risk. We monitor performance quarterly.

Participant Education & Advice

We deliver engaging group education and one-on-one consultations with SEC-licensed advisors—no sales, just support.

Plan Design Consulting

We help you optimize your plan through auto-enrollment, Safe Harbor matching, QDIA selection, and more, based on your goals.

WHY WE STAND OUT

raffa knows nonprofit and association retirement plans

We embrace our fiduciary duty

Fiduciary first

Built for Nonprofits & associations

Retirement Services for nonprofits

We help you make smart choices

we help your participants

Hear from Our clients

TESTIMONIALS

LATEST NEWS

Raffa Thought Leadership

Resources from Raffa for your retirement plan.

FAQs

Does Raffa serve as a fiduciary for our plan?

Yes. We serve as either a 3(21) or 3(38) fiduciary and always act in your best interest.

Why Raffa for our Retirement Plan?

Raffa was created specifically to serve nonprofits and associations. That mission drives everything we do — including how we manage retirement plans. We approach retirement plan management as a form of advocacy — for participants striving to achieve financial security and for plan sponsors working to deliver a compliant, efficient, and high-performing benefit.

What’s your Focus as a Dedicated Advocate for Participants?

- Relentless focus on the best interests of participants — from investment options to fee fairness

- Ensuring access to high-quality, low-cost investment choices

- Providing independent education and guidance to help participants make informed decisions

- Promoting transparency so participants understand their plan and how to use it effectively

- Aligning plan design and investment menus to support meaningful retirement outcomes

What’s your Focus as Dedicated Advocate for Plan Sponsors?

- Day-to-day partnership to simplify plan administration and stay compliant

- Translating recordkeeper language into clear, actionable guidance

- Proactively identifying opportunities to improve plan design and efficiency

- Ensuring recordkeepers deliver the service and responsiveness sponsors expect

- Acting as a single point of coordination among vendors, saving sponsors time and frustration

Does Raffa provide investment advice to participants?

Yes. We offer personalized, non-sales-based advice through group sessions, private consultations, and email support.

How Does Raffa monitor investments?

We use a proprietary scoring model that evaluates risk, cost, performance, and alignment. Funds are monitored quarterly with watchlist reporting that’s provided to your plan sponsor.

Does Raffa help with provider changes or fee benchmarking?

Yes. Our vendor RFP process is focused on reducing plan expenses and identifying the best partners to help service your qualified and non-qualifed retirement plans.

Are Raffa's services limited to nonprofits?

No. We also serve as the adviser to for-profit 401k plans as well.

Disclosures: Data