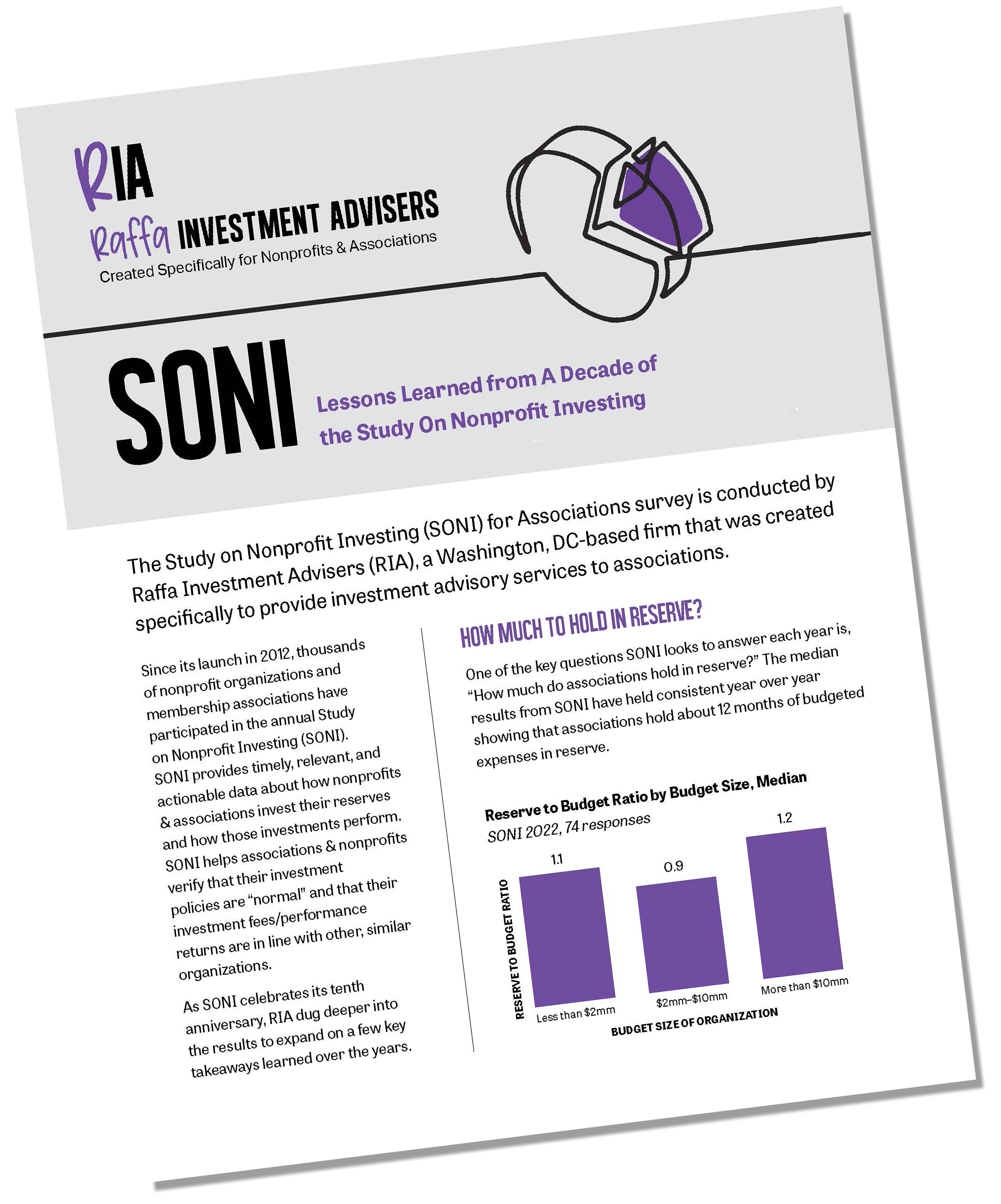

Launched in 2012, the annual Study on Nonprofit Investing (SONI) provides timely, relevant, actionable data about how associations and other nonprofits invest their reserves and how those investments perform.

Launched in 2012, the annual Study on Nonprofit Investing (SONI) provides timely, relevant, actionable data about how associations and other nonprofits invest their reserves and how those investments perform.

SONI helps nonprofit organizations verify that their investment policies are “normal” and that their investment fees/performance returns are in line with other, similar organizations. To date, more than 2,000 nonprofit organizations have participated in SONI.

SONI data is collected through an annual survey of nonprofit executives. Any organization can participate and survey answers are self-reported by participants. Raffa Wealth Management aggregates the data and groups the results by nonprofit type (public charity or association) and budget/portfolio size. Three distinct reports are produced and published:

● SONI Executive Summary

● SONI Associations

● SONI Public Charities

Survey participants receive the reports for free. Nonprofit executives use the reports to facilitate discussion with their boards and investment committees.