Learn more about Traditional verses Roth contributions for your retirement plan.

Traditional contributions to your retirement plan reduce your taxable income in the year the contribution is made. Distributions are fully taxable in the year that they are made.

Roth contributions are the opposite. The contributions you make are taxed in the year you make them, but when you withdraw from the account, as long as the funds have been in the account for a required time period you do not owe taxes on that amount.

When determining which type of contribution is best for you, the short answer is, it depends.

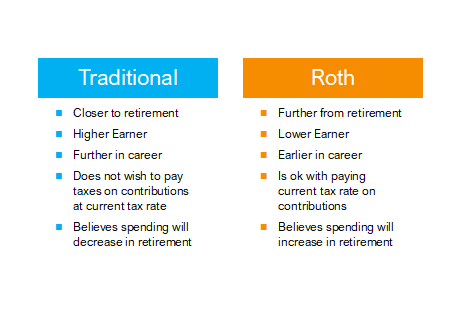

Traditional contributions tend to be better for people who think that their taxable income in retirement will be less than their taxable income now. Roth contributions are better for people who think that their taxable income in retirement will increase. Profiles for each group typically look like this:

It is important to recognize that even if you fall into these broad groups, it is always best to consult with a tax professional to determine which type of contribution is best for you.