After logging strong returns in 2017, global equity markets delivered negative returns in US dollar terms in 2018.

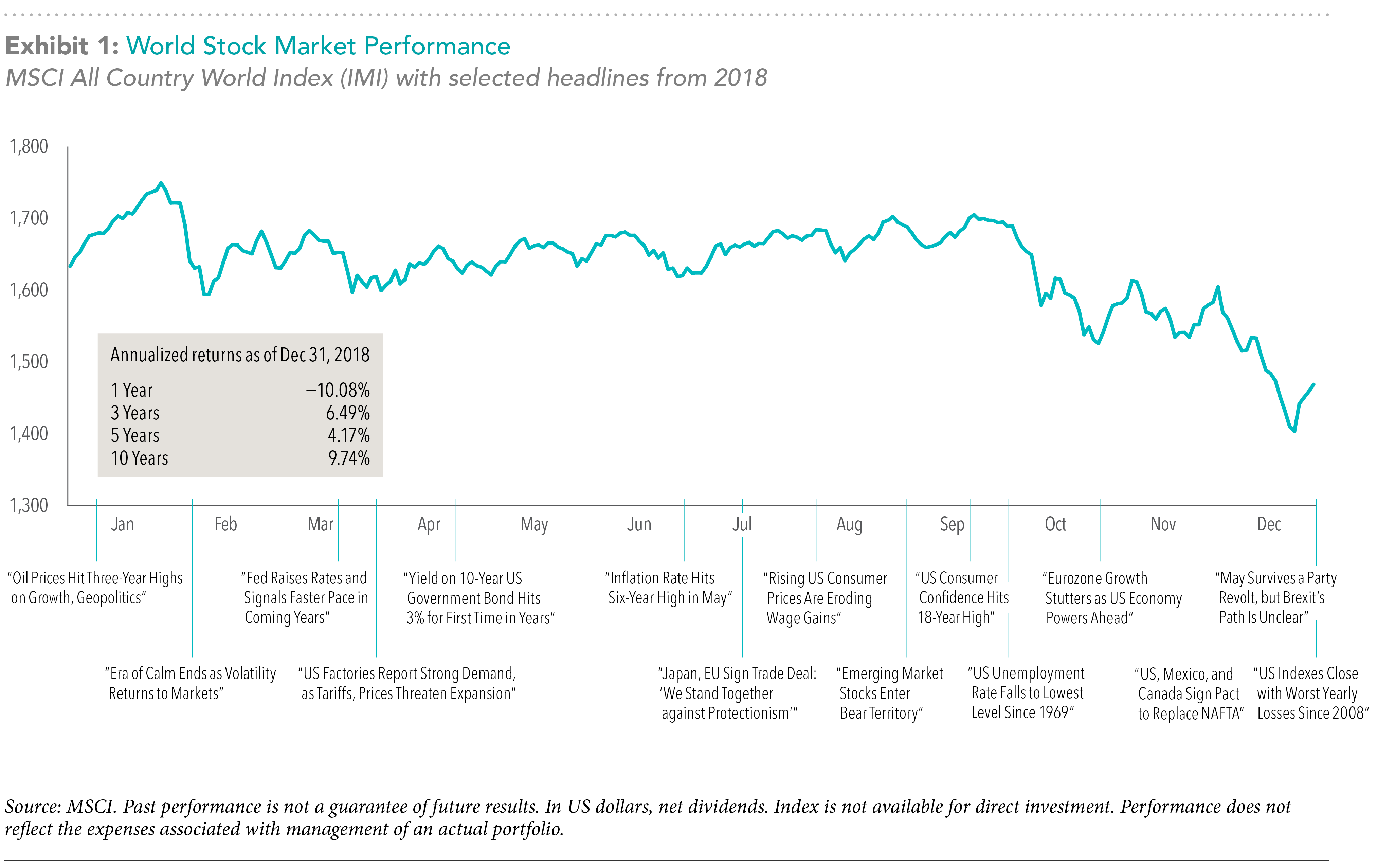

Common news stories in 2018 included reports on global economic growth, corporate earnings, record low unemployment in the US, the implementation of Brexit, US trade wars with China, and the Federal Reserve’s decisions on whether to raise interest rates. Having an opportunity to take a step back and be reminded of all that happened in 2018 provides a valuable reminder of the power of “tuning out the noise”. In the below graph, the performance of the global stock market is shown next to major news headlines in 2018.

Despite the doom and gloom to end 2018, things can change quickly. Through February 5th, US stocks (measured by the Russell 3000 Index) are up over 10% for the year and the broad bond market (measured by the BBgBarc US Agg Bond Index) is up 0.88%. Investing prudently doesn’t need to involve successfully forecasting the future direction of the market. It does, however, involve tuning out the noise and letting your rebalancing guidelines drive buying and selling decisions.

Although the current run in the market has provided a swift recovery from 2018 lows, there is certainly no guarantee that run will continue. What we do know is that maintaining discipline is crucial to effectively pursue the long-term returns the capital markets offer. Heading into the 2nd month of 2019, the following quote by John McQuown, a member of the Board of Directors Dimensional Fund Advisors LP, provides useful perspective: “Modern finance is based primarily on scientific reasoning guided by theory, not subjectivity and speculation.”.