Vesting in a Retirement Account is an important, but often misunderstood aspect of a retirement plan.

In short, the vested balance is how much of the money that your employer contributes to your retirement you get to keep should you leave your organization. If your employer contributions are not 100% vested, you will leave some money behind if you change jobs. It is important to note, the money you put into your retirement account from your salary is always 100% vested.

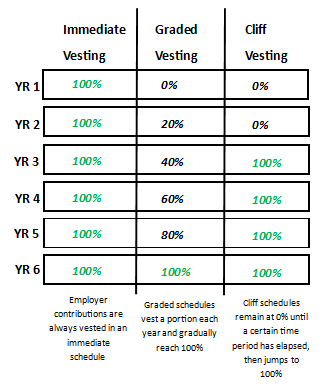

Vesting is determined by the amount of time you have worked at your organization and is identified by a vesting schedule. There are three types of vesting schedules that your plan may use. Immediate, graded or cliff. Below are examples of what each schedule looks like, though the exact structure of your vesting schedule may vary.

A common misconception about vesting schedules is that they begin when the employer makes the contribution. This is not the case. Vesting schedules begin on your date of hire. Once you are fully vested, all future employer contributions will also be fully vested.

Understanding your organization’s vest schedule, and where you are on it, can help you accurately make assessments and decisions about your retirement strategy – and will help you understand whether or not you are “leaving money behind.”