2019 has seen optimism spread to the capital markets with traditional asset classes all posting strong returns to start the year. As investors’ fears dissipate and we bask in the tremendous run that has marked the start of the year, let’s examine the role of high-quality fixed income in your portfolio as a tool to mitigate the effect of any equity volatility we will experience in the future.

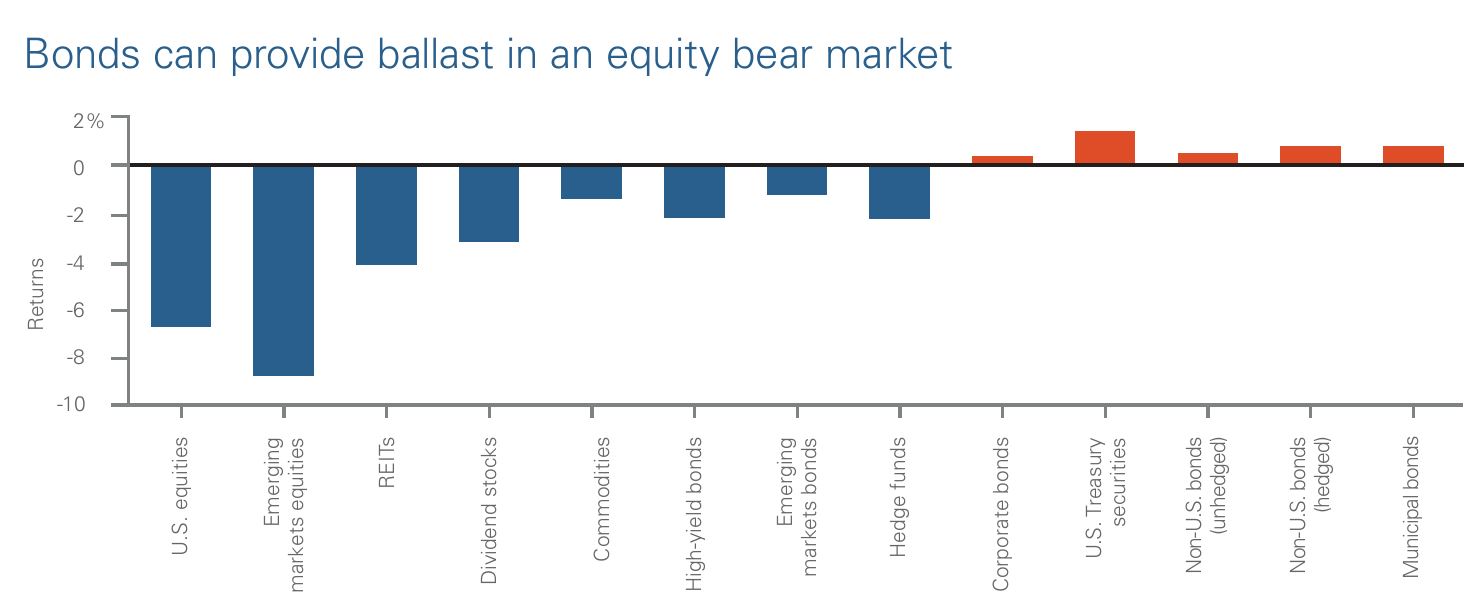

The following chart demonstrates the power of having allocations to high-quality fixed income that won’t always move in lock-step with the equity markets. In this example, the worst monthly US equity returns are illustrated to examine how other asset classes compared. Although exposure to other asset classes, including international equity, emerging markets, and REITs, may provide your portfolio with a meaningful diversification benefit, high quality fixed income proves to be one of the best ways to diversify a portfolio to lessen the impact of an equity downturn.

As 2019 runs its course, remember the role of exposure to high quality fixed income in a portfolio. Faced with uncertainty in the equity markets, investors will tend to move money into safe-haven investments like high quality bonds, thereby increasing the value of those investments. Although we’ve seen a great rally in stocks since December, it’s hard to understate the important role high-quality fixed income plays in a balanced portfolio.