US stocks have jumped over the first 8 months of the year with the Russell 3000 Index rising 18.0%[1]. International stocks, while posting strong absolute performance, have lagged behind US stocks by gaining 9.1% as measured by the FTSE All World Ex US Index. This trend of US stocks outpacing international stocks has occurred for much of the past decade. Given that backdrop, we thought it was a good time to revisit why we still believe there’s a benefit to investing internationally.

We like to say that diversification is the only free lunch in investing. The more diversification the better. By diversifying globally in equity markets across sector, size and style categories, an investor reduces risk. Over 40% of the global equity market, measured by market capitalization, and an additional 6,000 plus companies exist outside of the U.S. Beyond that, 96% of the world’s population and 77% of the world’s economy sits outside the U.S.[2] A large portion of the global stock market would be excluded by only investing in the U.S. A breakdown is shown in the chart below. If the U.S. suffered through a period of poor returns unique to the country, then a U.S. only investor’s portfolio will suffer. There are significant opportunities for companies based outside the U.S. to tap that we expand on below and we believe an investor would benefit from investing in these companies.

International equity provides a portfolio exposure to market influences that expand beyond the U.S. market. Countries around the globe are in various stages of the business cycle and have different governments that are implementing various monetary and fiscal policies all of which create different opportunities for business. These factors help drive different performance for international stocks than U.S. stocks. Put another way, international stocks and U.S. stocks are not perfectly correlated, which means there is the potential for international stock markets to perform well when the U.S. is not. This helps reduce the risk or volatility of an investor’s equity allocation.

By avoiding investing outside of the U.S., an investor would not invest in many top companies in their industries including Nestle, Toyota, Roche, and Samsung. We feel avoiding investing in these, and many other top companies, because they are based outside of the U.S. is a mistake. The U.S. stock market is also very top heavy with a few of the largest companies driving the lion’s share of recent performance. The below chart shows that if the 7 top contributors were removed from U.S. and international stock markets, international stocks would have outpaced U.S. stocks over the year to date. While these stocks have helped recently in the U.S., their outsized influence can also have the opposite effect.

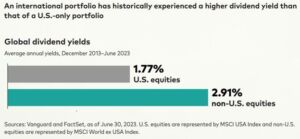

International stocks have historically also provided higher dividend yields than U.S. stocks. The below chart shows international stocks have over a 1% higher dividend yield than U.S. stocks over the past 10 years.

There are many historical examples of the performance benefit of international investing. Over the 1980’s and 2000’s foreign stocks outpaced those in the U.S. significantly. From 1980 to 1989, international stocks as measured by the MSCI World Ex US Index outpaced U.S. stocks as measured by the Russell 3000 Index by 4.07% annually. Similarly, from 2000 to 2009, international stocks outpaced U.S. stocks by 1.82% annually using the same indices. There will likely be another extended period of time in the future when international stocks outpace those in the U.S.

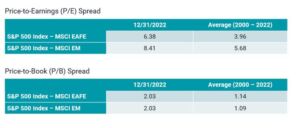

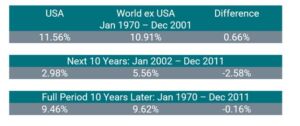

Finally, international stocks are trading at much lower valuations compared to U.S. stocks. This has shown historically to lead to higher future long term returns as valuations tend to revert to historical norms over time. The below charts show the current relative differences in the valuation ratios price-to-earnings and price-to-book between U.S. stocks and developed and emerging market stocks. As of the end of 2022 valuation spreads were significantly higher than their historical averages.

The last time we saw discrepancies this large between U.S. and international stock valuations, international stocks performed much better over the ensuing 10 years. They performed so well over that 10 year stretch that they outpaced U.S. stocks going back to 1970 as a result.

While international stocks have trailed U.S. stocks for much of the past decade, we believe there are compelling reasons to continue to invest abroad. Investing internationally has shown historically to reduce overall portfolio risk, deliver periods of outperformance, and provide exposure to a higher dividend yield. Investing internationally also offers the current ability to invest at lower valuations than in the U.S., raising expectations for future returns.

[1] Source: Morningstar, Inc.

[2]As measured by Gross Domestic Product (GDP) as of 2022.