What nonprofits and associations need to know about performance, fees and investment oversight

Values-based investing has benefitted investors by allowing them to reflect their organization’s mission, beliefs and values in their investment portfolios. By avoiding or increasing exposure to specific companies, sectors, or business practices, organizations can align their investments with their values and avoid conflicts of interest. The rise of values-based investing, particularly over the past decade, means that it’s easier now than ever to incorporate your values into your investments.

Values-based investing, often referred to with the acronyms ESG (Environmental, Social, and Governance) or SRI (Socially Responsible Investing) can look different from organization to organization. There are different ways to reflect your values in your investments, various fees to consider, differing investment strategies to review, and unique governance impacts to take into account when looking to align your investments with your values.

Is Values-Based Investing Right for YOur Nonprofit?

Here we take a deeper look with the goal of answering the burning question many nonprofit organizations have: is values-based investing right for us?

Values-based investing is right for you if your organization has clearly defined values that are critical to your mission, or if investing in certain companies or sectors presents a conflict of interest. We recommend a comprehensive process, including interviews with key stakeholders and a tailored survey of your Board, to gain consensus around your organizational values and how best to reflect them in your investments. The goal is to make sure that your organizational values are clearly agreed upon such that when your stakeholders change, your commitment to a values-based investment strategy doesn’t.

What is the Potential Impact of Values-Based Investing on Performance?

When beginning to think about this type of investing, one of the most common questions we receive is, “What is the potential impact on investment performance? If I exclude certain companies or sectors, will I underperform the market? What will my returns look like?”

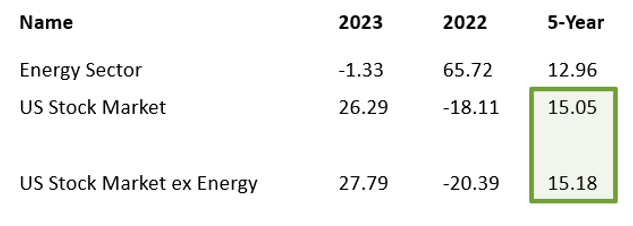

Below we’ve outlined a case that illustrates this concept. Excluding certain companies, or industries, can lead to deviation from the market’s performance. Some organizations, for example, may want to exclude investing in the energy sector if their mission or values don’t align with fossil fuel dependency or oil & gas production. As illustrated below, exclusions like this over short time periods can cause differences in performance from the overall market. However, stretching out over longer time periods, the return for a portfolio excluding energy stocks has been very similar to the overall market return that includes those companies.

Key Takeaway: In the short-term, your decision to emphasize or restrict investments based on your values may lead to performance deviations, but over longer time periods those performance deviations can be minimal.

Exhibit 1:

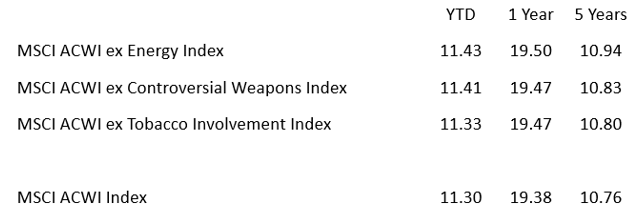

We’ve also looked at other common exclusions that values-based investors make. Similar to the illustration above, it’s clear that over longer time periods, the returns for a portfolio excluding certain investments look very similar to an overall market return, meaning yes, it is possible to have a market-like return while investing in a way that suits your preferences.

Exhibit 2:

Will my Fees be Higher with a Values-Based Investment Strategy?

Another common question about values-based investing is, “Will my fees be higher?” ESG and SRI funds are customized, and can exclude or emphasize different companies, practices or sectors compared to a typical index fund – “doesn’t that mean they’re more expensive? Is reflecting my values in my investments going to increase my investment fees and expenses?” They certainly do not have to be higher. With more and more ESG and SRI-focused mutual funds and exchange-traded funds (ETFs) being launched in recent years, the competition among fund managers to keep expenses reasonable has been a win for investors. It’s important to work with an adviser who can help you navigate the investment options to find the best solution while considering fees.

In 2023, the asset-weighted average expense ratio across all open-end mutual funds and ETFs was 0.36%¹. There are many ESG and SRI funds that deliver values-based solutions at an even lower fee than that average. Even values-based investments through a Separately Managed Account, which allows complete customization in terms of how you bring your values to life through your investments, can be less expensive than that 0.36% average, which is great news for those seeking to align their investments with their values.

Key Takeaway: Reflecting your values in your investments doesn’t mean your fees will be unreasonable.

How Does My Organization’s Investment Oversight Change with a Values-Based Investment Strategy?

Another critical component of values-based investing is the additional oversight required by your volunteers to hold your adviser or investment committee accountable for their decision making. The good news is that the rise of values-based investing means that there are investment solutions available that allow your investment adviser or investment committee to implement their strategy while also reflecting your values. Say your adviser or finance committee wants to emphasize growth stocks, tech companies, international stocks, and shorter-term, high credit quality bonds. Through an abundance of investment options, they can implement this strategy while still incorporating your values (for example eliminating exposure to alcohol & tobacco companies, or emphasizing companies with gender diversity on their Boards, etc.). What becomes important for governance and oversight is to understand what the performance impact of your adviser’s strategy is vs. what the performance impact of your values is. Did your decision to eliminate exposure to alcohol & tobacco companies add value or was it the adviser’s decision emphasize tech companies? Understanding these differences, and educating your volunteers, is crucial for effective oversight of a values-based investment program

As there are a number of factors to consider when it comes to values-based investing, it’s important to be informed while going through the process of aligning your investments with your values. This type of investing has come a long way in recent years, and there are some key takeaways to note if you decide this is right for your organization:

- You aren’t doomed to higher fees,

- Your performance will deviate from the market’s return over the short term, but over the longer term those deviations should narrow.

- Your adviser or investment committee’s strategy decisions can still add value.

- Its important to understand how your values and other strategy decisions impact performance.

If you’d like to learn more about your options and if values-based investing is right for you, reach out to us today.

Disclosures:

<