The Federal Reserve (often called “the Fed”) has been front and center in recent headlines, with markets reacting sharply to each announcement and speech. For individual investors, these developments can feel distant or overly technical, yet they have real implications for your portfolio. That’s why it’s important to step back and consider the bigger picture: What does the Fed do, and why does it matter for your investments?

What Is the Federal Reserve and How Does It Affect the Economy?

The Federal Reserve, established in 1913 as the nation’s central bank, is responsible for promoting a stable financial system and a healthy economy. It carries out this role by setting short-term interest rates and, when needed, using its balance sheet to influence the availability of money and credit.

Key features of the Fed include:

- Board of Governors in Washington, D.C., appointed by the President and confirmed by the Senate.

- 12 Regional Reserve Banks across the country, which gather local economic insights.

- Federal Open Market Committee (FOMC), made up of the Board of Governors and five Reserve Bank presidents, which meets regularly to set interest rate policy.

- Dual mandate: price stability (low, stable inflation) and maximum employment.

The Fed’s policy decisions ripple through the economy and markets. Raising rates makes borrowing more expensive for households, businesses, and governments, which can slow spending and investment, while lowering rates does the opposite by stimulating growth. Markets often react immediately — sometimes more strongly to the Fed’s guidance than to its actual moves. For individual investors, this means Fed policy directly affects interest paid on mortgages and loans, as well as the risks and opportunities in cash, bonds, and stocks.

Recent Fed Action: September 2025 Meeting

At its September meeting, the Federal Reserve cut its benchmark interest rate by a quarter of a percent, bringing it down to a target range of 4.00%–4.25%. It was the first rate cut since December 2024. The Fed also confirmed it would continue gradually reducing its large holdings of government bonds, part of its broader effort to guide financial conditions.

The decision highlights the difficult balance the Fed is facing. On one hand, inflation is still running above its 2% target, which argues for keeping policy restrictive. On the other hand, economic growth has cooled, job gains have moderated, and the unemployment rate has edged higher — all signs that the labor market is weakening. By cutting rates, the Fed signaled that it is increasingly concerned about supporting employment and growth, even as it continues to monitor inflation pressures closely.

What to Expect Going Forward

Following the September meeting and Fed Chair Jerome Powell’s remarks, the Fed has signaled a shift back towards easing after not making any adjustments to monetary policy since December. Markets are now pricing in additional rate cuts over the coming 12 months as the Fed balances two competing objectives: bringing inflation down to its 2% goal and avoiding undue harm to the labor market as job gains have slowed and unemployment has edged up.

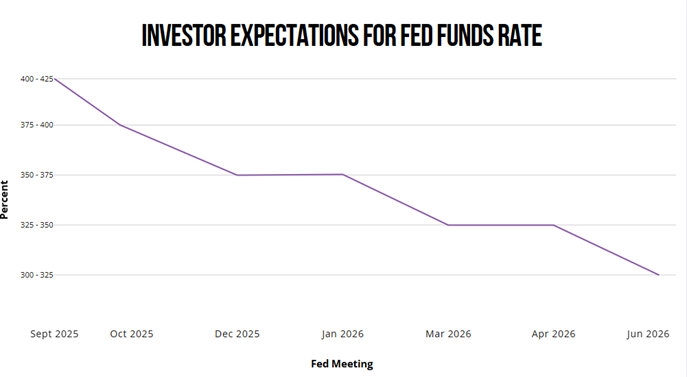

The below chart[1] displays investor expectations for interest rate cuts as of the end of September through next summer.

[1] Data source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html?redirect=/trading/interest-rates/countdown-to-fomc.html

Investors currently expect four quarter-point interest rate cuts between now and next summer, and those expectations are already reflected in today’s stock and bond prices. Market participants are watching incoming data closely — especially monthly inflation reports and payroll numbers — because the Fed will ease only if inflation continues to moderate and the labor market shows signs of cooling. If inflation proves stickier than expected, the Fed may delay or scale back cuts. Conversely, if growth and employment weaken further, additional quarter-point cuts are likely. In either case, new data will be quickly incorporated into market expectations for the Fed’s path, potentially sparking significant volatility even before the Fed takes any formal action.

What It Means for Your Portfolio

For investors, this environment of likely but uncertain rate cuts has direct implications. Markets are expecting a path of gradually lower short-term rates over the next year, but the timing and size of those cuts will depend on economic data.

- Borrowing: Mortgage rates may not fall much in the near term since they are tied more to long-term bond markets than to the Fed’s short-term rate. By contrast, auto loans and other shorter-term borrowing are more likely to decline as the Fed eases.

- Cash and equivalents: If the Fed continues to lower rates, yields on money market funds, CDs, Treasury bills, and savings accounts will decline, reducing the income you earn from conservative holdings.

- Fixed income: Shorter-term bonds are likely to see rates fall to a greater degree than intermediate term bonds. We believe that retirement portfolios should target an intermediate term duration as intermediate term bonds are likely to benefit from some price appreciation while still offering a healthy yield.

- Stocks: Rate cuts generally support equity markets by easing borrowing costs and encouraging economic growth. However, if the job market weakens significantly and growth slows, stock prices could face renewed pressure.

Our approach is to remain disciplined and diversified: ensuring adequate liquidity for near-term needs while positioning longer-term investments for growth. Fed cycles can create short-term noise, but they do not alter the importance of aligning your portfolio with your goals, time horizon, and risk tolerance.

Conclusion

The Federal Reserve’s decisions shape the path of interest rates, inflation, and economic growth — all of which directly influence your investments. While headlines often focus on the immediate market reaction, what matters most is maintaining a disciplined, diversified approach that keeps your portfolio aligned with your long-term goals.

Fed cycles may bring short-term volatility, but they do not change the long-term importance of thoughtful investment strategy, prudent risk management, and staying focused on the bigger picture.

Disclosures:

Raffa actively leverages Artificial Intelligence (“AI”) and Large Language Models (“LLMs”) within our operations. The use of such technologies, focusing on the safeguard of non-public personal information (“NPPI”), protecting of trade secrets, verification of information accuracy, and other pertinent compliance considerations, is outlined in Raffa’s Compliance Manual and acknowledged by Raffa staff. All viewpoints and final content created was reviewed and approved by the Raffa team to verify accuracy, perspective, and compliance with our marketing guidelines.

For informational purposes only. All figures in USD. Indices are not available for direct investment. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. Actual returns may be lower.

All economic and performance information is historical and not indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

You should not assume that any discussion or information provided here serves as the receipt of, or as a substitute for, personalized investment advice from Raffa Investment Advisers or any other investment professional.

The charts and graphs contained herein should not serve as the sole determining factor for making investment decisions. To the extent that you have any questions regarding the applicability of any specific issue discussed to your individual situation, you are encouraged to consult with Raffa Investment Advisers.

All information, including that used to compile charts, is obtained from sources believed to be reliable, but Raffa Investment Advisers’ does not guarantee its reliability. All performance results have been compiled solely by Raffa Investment Advisers’, are unaudited, and have not been independently verified. Information pertaining to Raffa Investment Advisers’ advisory operations, services, and fees is set forth in Raffa Investment Advisers current disclosure statement, a copy of which is available from Raffa Investment Advisors upon request.