in assets under

advisement (AUA)

nonprofit and association

clients

years of combined

experience serving

nonprofits & associations of

Raffa’s five advisers

nonprofit client retention

rate over the past 10

years*

years supporting the

investment and fiduciary

needs of nonprofits &

associations

- Kathy and Tom Raffa founded Raffa, PC, a public accounting, consulting, and technology firm in Washington, DC

- Raffa Financial Services launched to include insurance, investment, and employee benefit brokerage services

- Raffa Investment Advisers was created specifically to serve the investment and fiduciary needs of nonprofits and associations, selecting Charles Schwab Institutional as preferred custodian

- Raffa launches SONI – the Study on Nonprofit Investing to provide timely, relevant, actionable data about how nonprofits & associations invest their reserves and how those investments perform

- Raffa Social Capital Advisors was launched to support social entrepreneurs and social impact investors

- The Raffa family of companies employs more than 300 professionals and serves over 1,000 nonprofit organizations around the country

- Raffa Investment Advisers serves 140 different nonprofit and association clients. Raffa has assets under advisement of $1.6B

OUR MISSION

Raffa Investment Advisers is owned by two principals, each of whom is an original founder: Tom Raffa and Dennis Gogarty. Mr. Raffa is not involved in the firm’s daily operations or investment advisory considerations.

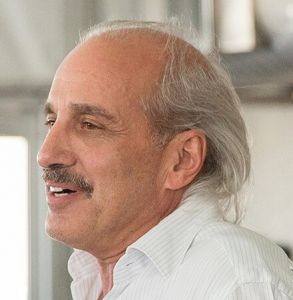

Tom RAFFA

Co-Founder and Principal

As a social entrepreneur, Tom has spent his entire career focused on catalyzing positive systemic change throughout the community. The multiple organizations that he’s created and incubated, as well as the multiple levels of support Raffa companies have provided and channeled, have been instrumental in advancing the U.S. nonprofit sector. With almost 300 professionals combined, Raffa, P.C., along with Raffa Financial Services, Inc. and Raffa Investment Advisers have helped hundreds of great organizations thrive.

Dennis P. Gogarty, CFP®, AIF®

President, Principal, Co-Founder

Dennis launched his investment advisory career with Raffa Financial Services, Inc. in 2002 and co-founded Raffa Investment Advisers in 2005. He has served as the firm’s President and lead investment adviser representative ever since.

A major focus of Dennis’ career is promoting the need for increased investment education and transparency. He is the founder of the Study on Nonprofit Investing (SONI), an annual study promoting access to information that allows nonprofits to benchmark their investment performance and policies with their peers.

Dennis is a past Chair of the American Society of Association Executives (ASAE) Finance Section Council. Additionally, he offered his knowledge and expertise to support local nonprofits as a volunteer committee member for organizations including St. John’s Community Services Foundation and Street Law. Dennis has lectured on issues impacting nonprofit investing for the following organizations: the Council on Foundations, the Greater Washington Society of CPAs, the AICPA, the American Society of Association Executives (ASAE), BoardSource, and the Finance and Administration Roundtable (FAR).

Dennis completed the Certificate in Financial Planning program at the Georgetown University Center for Continuing and Professional Education and earned a Bachelor of Science degree from Frostburg State University. Dennis is a Certified Financial Planner™, an Accredited Investment Fiduciary®, and an investment adviser representative of Raffa Wealth Management, LLC.

720.514.1085

mark@raffaadvisers.com

Mark P. Murphy is Raffa Investment Adviser’s Chief Investment Officer. Mark supports all areas of the firm’s analytical and due diligence processes and leads and develops the firms overall investment strategy. Mark has been with Raffa Investment Advisers since 2010.

Mark has lectured on issues impacting nonprofit & association investing for the following organizations: the Greater Washington Society of CPAs, the American Society of Association Executives (ASAE), BoardSource, Association TRENDS, and the Finance and Administration Roundtable (FAR).

Mark graduated from the University of Richmond, cum laude with a Bachelor of Science degree in Business Administration with concentrations in Accounting and Finance. A Chartered Financial Analyst charterholder, Mark earned the right to use the CFA designation after meeting the CFA Institute’s educational and professional requirements. The CFA designation is globally recognized and attests to a charterholder’s success in a rigorous and comprehensive study program in the field of investment management and research analysis. Mark is a member of the CFA Society of Washington D.C. and the Greater Washington Society of CPAs Nonprofit Section. He is an investment adviser representative of Raffa.

202.955.7208

ryan@raffaadvisers.com

Ryan Frydenlund is Raffa Investment Advisers’ Director of Operations and ensures that clients receive an extraordinary level of service.

Ryan is involved in all areas of the firm’s business including portfolio management, business development, and administration. Ryan joined Raffa in 2017 and holds multiple industry designations focused on investment management and performance reporting. Ryan received his Certificate in Environmental, Social, and Governance (ESG) Investing, administered by the CFA Institute, in 2022.

Ryan has lectured or been quoted on issues impacting nonprofit & association investing for the following organizations: Marcum’s Nonprofit Learning Community, the American Society of Association Executives (ASAE), Association Forum, CalSAE, and Association TRENDS.

Ryan graduated from Wake Forest University with a Bachelor of Science in Finance. Ryan is a member of the CFA Society of Colorado, the Colorado Society of Association Executives, the American Society of Association Executives, and Association Forum. Ryan is an investment adviser representative of Raffa Investment Advisers.

202.955.6722

joe@raffaadvisers.com

Joe Guest is Raffa Investment Advisers’ Senior Portfolio Manager.

202.955.7224

matt@raffaadvisers.com

Matt is a Portfolio Manager and works with our nonprofit clients to gain a deep understanding of their investment goals, risk profile, and what makes them unique. From policy development and board education to portfolio construction and managing investments, Matt takes pride in serving our clients in a variety of ways so they can focus on serving their organizations. Matt is a Certified Investment Management Analyst® and investment adviser representative of Raffa. He is active in the nonprofit community and is a member of FAR and NoVa Associations; he hosted a roundtable event for the latter discussing association investing and what makes nonprofit investing unique.

Matt joined Raffa in 2022 and began working in the financial services industry after graduating from the University of Maryland in 2018 where he earned a Bachelor of Science degree studying economics and statistics. Prior to joining Raffa, Matt worked for Cambridge Associates, LLC, where he helped their client data team streamline their investment data management and client reporting systems through leveraging automation. Matt resides in Arlington, Virginia. He loves staying active by playing tennis & golf and rooting on his favorite DC sports teams.

202.987.7585

samantha@raffaadvisers.com

Samantha Pnazek is the Client Service Manager at Raffa Investment Advisers, having joined the team in 2023. With 10 years of experience in financial services, she ensures smooth operations and delivers exceptional client service by overseeing administrative functions and proactively supporting clients’ needs. Samantha earned her Bachelor of Science in Commerce & Business Administration from the University of Alabama.

Residing in Birmingham, Alabama, Samantha loves spending time with her husband, two daughters, and their dog.

202.769.0557

michelle@raffaadvisers.com

Michelle joined Raffa as an Operations Associate in 2023 and provides support in reporting, trading, and operational functions. She started her career in the financial services industry after earning a Bachelor of Science in Finance from West Chester University in 2020. Before joining Raffa, Michelle worked at State Street, where she provided support to investment management clients through trade reconciliation, reporting, and processing. She currently resides in Philadelphia, Pennsylvania, and enjoys spending time with her family, friends, and her dog.

202.955.7208

ryan@raffaadvisers.com

As Director of Operations, Ryan Frydenlund has supported Raffa’s clients since 2017. Ryan’s expertise includes handling complex issues across account setup and maintenance, reporting, billing, and more. In his current role, Ryan works hand in hand with Samantha Pnazek and Michelle Heery to ensure the firm’s operations are as efficient as possible and our clients receive an extraordinary attention to detail and service experience.