If you’ve felt like stock prices were a little more volatile in 2022 than in recent years, your “spidey senses” are right on the money.

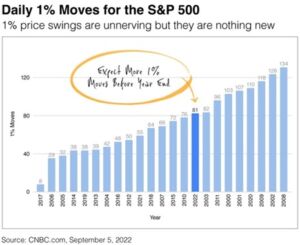

The S&P 500 has posted 81 daily moves of at least 1% through August. Of those moves, 39 have been to the upside and 42 to the downside.

In the chart below, 2022 is highlighted to show how it compares to other years since 2000. Since the daily report was compiled, stocks have seen a few more 1% swings. With more than 30 trading days left in the year, it’s likely we could see more.

What’s fueling the volatility? The Fed, largely. Its monetary policy of raising interest rates to slow inflation without triggering a recession has created a lot of uncertainty. Their policies, however, appear to be doing their job based on the lower-than-expected inflation rate reported last week which in turn, lead to another big swing in the stock market.

Price swings are unnerving, but as the chart shows, they are nothing new. What’s most important is focusing on your goals and not paying too much attention to Wall Street’s daily ups and downs.

While stock market volatility can be nerve-racking for investors, reacting emotionally and changing long-term investment strategies in response to short-term declines could prove more harmful than helpful. By having specific rebalancing thresholds that dictate when to make trades in your portfolio to bring it back in line with its target asset allocation, RIA looks to bring discipline to the investment process and avoid letting emotional reactions dictate buying and selling decisions. Although the markets may move in any direction over the short term, buying into what is below target using proceeds from what is above target is a disciplined approach that maintains a portfolio’s long- term focus. We also look to utilize any cash flows into or out of a portfolio as an opportunity to rebalance. While markets continue to be volatile in the short-term, please let us know if you have any upcoming withdrawals or contributions we should be aware of.

Another important reminder of the benefit of remaining disciplined is the cost of trying to time the market as sitting on the sidelines waiting to get back into the stock market can be a costly strategy. The impact of missing even just a few days of strong returns can drastically impact overall performance. With the market being volatile this year, the chances of missing out on a particularly strong day are even more heightened.

Although it’s impossible to tune out the noise and focus solely on your long-term objectives when markets are volatile, it’s important to stick to the plan that has rewarded investors historically and enabled them to weather market lows: remaining disciplined and rebalancing to take advantage of market movements.

The S&P 500 Composite Index is an unmanaged index that is considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

DISCLOSURES

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed to be reliable, and we have reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations.