As part of the RWM investment strategy we seek to tilt the equity allocation of a portfolio towards value stocks. These are stocks that have low relative prices vs. their profits compared to growth stocks which have high relative prices vs. their profits. However, in recent years value stocks have trailed growth stocks. Is the recent under-performance by value stocks normal, and should we expect growth to continue to outperform?

Whether value stocks or growth stocks out perform in any particular year is a crap shoot. While value stocks have outpaced growth stocks by 3.5%* annualized over the 1927 to 2017 period, in any given year whether value or growth is in favor can vary wildly. In the last 15 years there have been 8 years where growth has outpaced and 7 years where value has outpaced.

Whether value stocks or growth stocks out perform in any particular year is a crap shoot. While value stocks have outpaced growth stocks by 3.5%* annualized over the 1927 to 2017 period, in any given year whether value or growth is in favor can vary wildly. In the last 15 years there have been 8 years where growth has outpaced and 7 years where value has outpaced.

The recent run of out performance from growth over value stocks is also in the middle of the pack when compared to other time periods. The chart below shows the 10 year time periods, since 1927, when value outpaced in blue and the 10 year time frames when growth outpaced in red. There have been other ten year time frames when growth has outpaced value by even more than the most recent 10 year time frame, so the recent comparative under performance is not unusual.

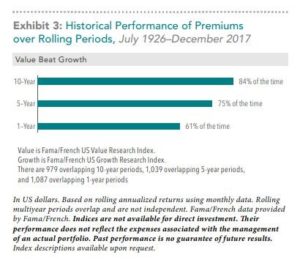

While there have been sustained periods of value trailing growth, historically value has still shown its worth. The chart below shows various time periods and the frequency with which value had been in favor over growth. As you can see the longer the time period the more likely it is that value had outpaced.

For further details see this article on the subject by Dimensional Fund Advisors.

For further details see this article on the subject by Dimensional Fund Advisors.

We continue to strongly believe in maintaining the tilt towards value in the equity allocation. While over any short period of time the tilt may not be in favor, we believe that by staying disciplined to the strategy over time best positions a portfolio for long term success.

*The return difference between the Fama/French US Value Research Index and the Fama/French US Growth Research Index