Investment Management for nonprofits and associations

Mission-aligned, modern investment services. Raffa Investment Advisers does not provide funding or offer assistance with fundraising.

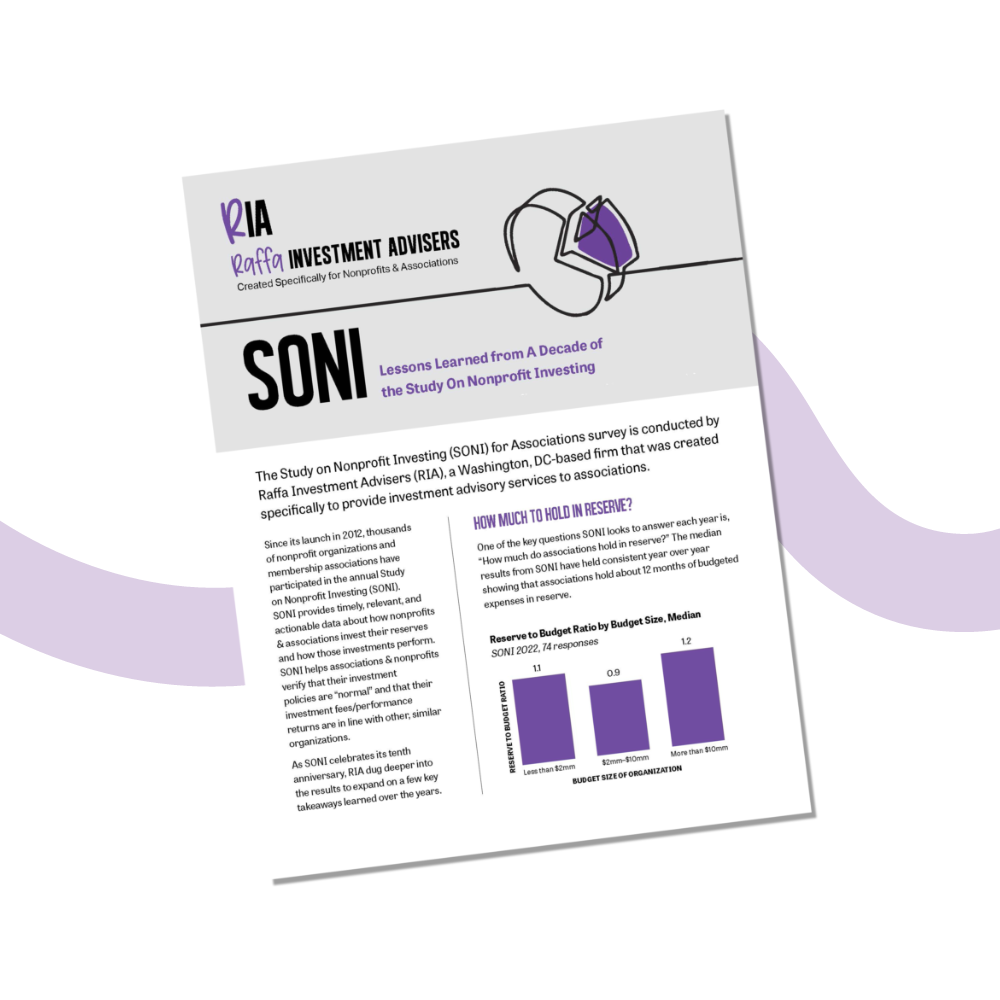

Unlock a wealth of knowledge with Raffa’s free downloads and resources, designed to empower nonprofits and associations on their financial stewardship journey.

in assets under

advisement (AUA)

nonprofit and association

clients

years of combined

experience serving

nonprofits & associations of

Raffa’s five advisers

nonprofit client retention

rate over the past 10

years*

years supporting the

investment and fiduciary

needs of nonprofits &

associations

Our team of financial advisors provides a modern, efficient approach to investing nonprofit and association reserves, endowments and retirement plans. Raffa supports 148 nonprofits and associations*, ranging from those with $500k in investable assets investing for the first time to those with more than $90M in reserve. *as of 7/31/24

We’ve had a great relationship with Raffa Investment Advisers for nearly five years. Their nonprofit experience and the qualifications of their advisors have allowed us to align investment strategy with our mission. The education they provide has been of great benefit to both our Board of Directors and Finance Committee. Raffa’s client communication is timely and on-target and the quality of reporting is always high.