From an investment standpoint, recent conditions have been something like a Halloween-themed hayride. Bumpy.. ok really bumpy, with a couple of scares here and there. But there’s news that may help calm your nerves…

Yields on CDs are at a recent all-time high as highlighted by an article in the Wall Street Journal. The Journal notes that CDs offered through brokers like Schwab are offering investors up to 4.5% and 4.1% for one-year and six-month brokered CDs, respectively. Now is a great time to begin considering putting any excess cash on hand to best use through Schwab’s FDIC insured cash management solutions. Please reach out to us as we’re happy to connect to put together a recommendation and answer any questions.

Investors have likely noticed the improved opportunity set in fixed income due to higher yields. And yet some investors may be hesitant to take advantage of higher yields because of concerns about future increases in yields. Some may even be considering reducing their bond exposure after this year’s negative returns for fixed income.1 The good news? If yields do keep rising, investors seeking higher expected returns may still be better off maintaining the duration of their fixed income allocation.

Rising yields impact fixed income portfolios in several ways. On the one hand, longer-duration portfolios may experience larger immediate losses from increased yields relative to shorter-duration portfolios. On the other hand, higher yields may lead to higher expected returns. Investors can think of this tradeoff as a pit stop in a Formula 1 race. The pit stop immediately causes the driver to fall back. However, fresh tires may help the driver win the race if there are enough laps left to catch the leader.

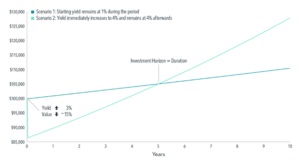

Exhibit 1 illustrates this using two scenarios for a $100,000 fixed income allocation with a five-year duration. Scenario 1 experiences a constant yield of 1% during the period. Scenario 2 is faced with a sudden spike in yield from 1% to 4% on Day 1 and sees its value immediately drop to a little over $86,000. However, the higher-yield environment accelerates Scenario 2’s recovery: With a 4% yield rather than the previous rate of 1%, Scenario 2’s portfolio value overtakes Scenario 1’s within five years—the time horizon determined by the duration of Scenario 2.

When faced with uncertainty, investors should focus on the things they can control. Research tells us that trying to outguess the market by holding on to cash, or shortening duration, with the expectation of future yield increases may not help you achieve your long-term goals.2 Markets quickly incorporate new information about higher interest rates and inflation.3 Investors who maintain appropriate asset allocations, even after increases in bond yields, may have a more rewarding investment experience in the long run.

GLOSSARY

Duration: A measurement of the sensitivity of the price of a fixed income investment to changes in interest rates. Generally, high-duration bonds will have greater sensitivity to changing interest rates than lower-duration bonds.

FOOTNOTES

- 1The Bloomberg Global Aggregate Bond Index (hedged to USD) returned –12.1% from January 1, 2022, through September 30, 2022.

- 2Mingzhe Yi, “All Eyes on the Fed? A Look at Federal Funds Rate, Bond Return, and Term Premium,” Insights (blog), Dimensional Fund Advisors, March 15, 2022.

- 3Wes Crill, “Light at the End of the Inflation Tunnel,” Insights (blog), Dimensional Fund Advisors, June 10, 2022; “Markets Appeared to Be Ahead of the Fed,” Insights (blog), Dimensional, June 16, 2022.

DISCLOSURES

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed to be reliable, and we have reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations.