As part of RWM’s investment strategy, we seek to tilt the equity allocations to emphasize companies with a value orientation.

Value stocks have low relative share prices vs. their profits compared to growth stocks which have high relative share prices vs. their profits. Although historically, value has outperformed growth[1], in recent years value stocks have underperformed relative to their growth stock counterparts. This underperformance is not unusual, and we continue to believe that emphasizing value stocks will benefit an investor over time. Reviewing recent time periods when value was also out of favor is a powerful reminder about the importance of discipline.

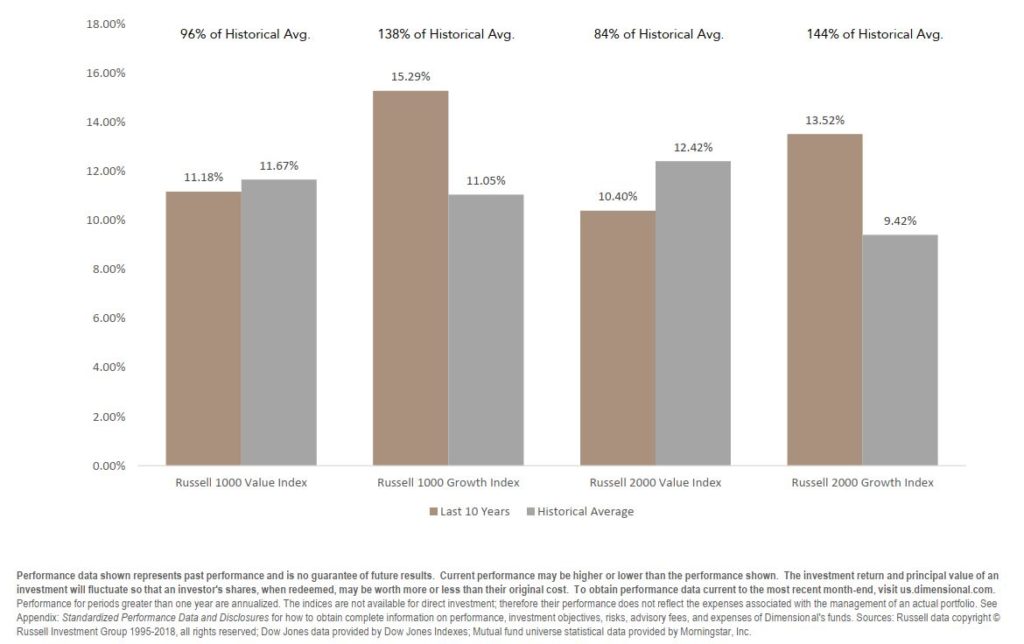

The chart below shows both the annualized return over the past 10 years as well as back to 1979 for four US stock indexes. The Russell 1000 Growth and Value indexes are comprised of large US companies, while the Russell 2000 indexes contain small-cap stocks. When compared to their historical averages, we notice that growth stocks have been in favor across large and small-cap stocks over the past 10 years.

Recent Premium Performance in Context

1979 – 2018

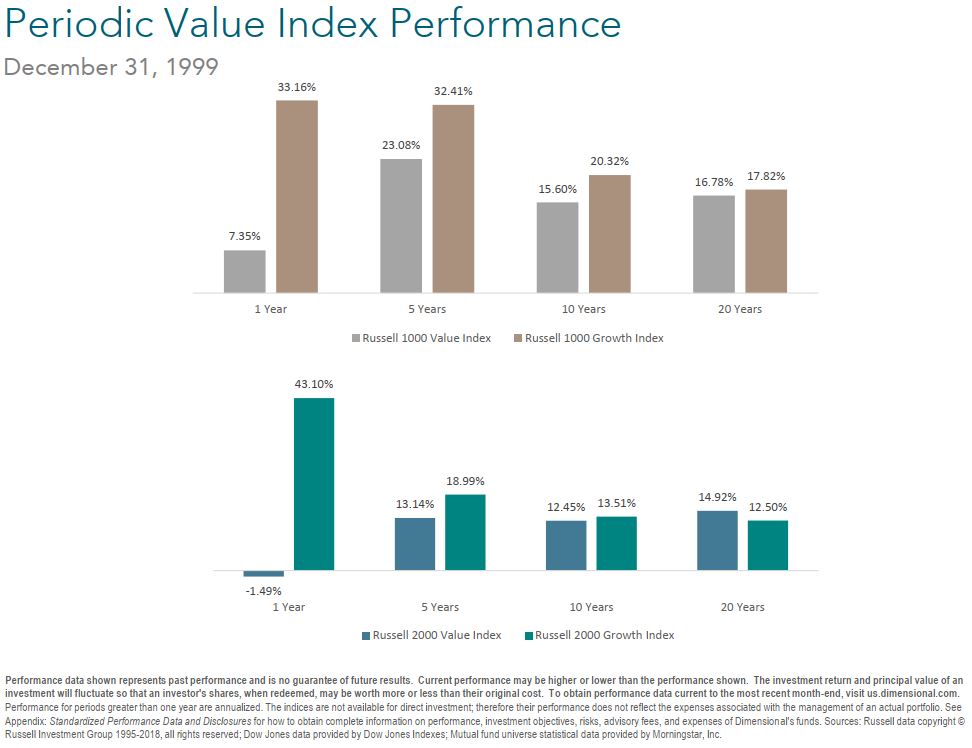

Strategies emphasizing value stocks were similarly out of favor near the end of the century. As many growth stocks, especially technology-related firms, soared in the mid-to-late 1990s, value strategies delivered positive returns but fell far behind in the relative performance race. At year-end 1999, value stocks had underperformed growth stocks over the previous 1, 5, 10, and 20 years, with the only exception being small-cap stocks over the last 20 years. Since the inception of the Russell indices is January 1979, this means that the available data (20 years) from the most widely followed benchmarks indicated superior performance for growth stocks. With value stocks falling so far behind in the relative performance race, it would seem reasonable that they would need decades of strong returns to catch up to growth stocks.

That, however, was not the case. After the dot-com bubble burst, the reversal to favor value over growth was dramatic. It took only a little over 2 years for value stocks to completely reverse course. By February 2002, value had outperformed growth across large and small-cap stocks over the past 1, 5, 10, and 20 years. Investors that had given up on the value premium in 1999 to chase what was in favor at the time would have found themselves disadvantaged.

While there is empirical evidence to support our expectation that value stocks will outperform growth stocks over longer time periods[2], we know that value and small caps can underperform over any given period. Results from previous periods reinforce the importance of discipline in pursuing the value premium.

[1] From July 1926 – December 2016, Value beat Growth 95% of the time over any rolling 15-year period. Value is Fama/French US Value Research Index. Growth is Fama/French US Growth Research Index. There are 907 overlapping 15-year periods.

[2] For more information, please read: https://raffawealth.com/is-value-providing-value/