It was a very difficult year for all investors. What does 2023 have in store?

After three straight years of returns from US stocks of over 18%1, 2022 was a major disappointment. US stocks fell over 19% for their worst year since the Financial Crisis. High quality bonds, which typically hold up well in times of significant stock market declines, fell more than 8%2.

The first half of 2023 will likely focus on the dominant theme of 2022 of decades high inflation and the Federal Reserve’s (Fed’s) efforts to tame it. While inflation has cooled over the second half of 2022 with the Consumer Price Index in December dropping to a 6.5% increase from a year prior, it still is much higher than what the Fed targets. The Fed has raised its benchmark rate to 4.5% and expects to raise it above 5% and maintain that level for 2023; a rate last seen over 15 years ago. Recent Fed comments have shown that they remain committed to bringing inflation down. While they are concerned about the risk of raising the fed funds rate too high, they feel the risk of letting inflation linger longer is the greater concern. Investors currently expect the fed funds rate to peak near 5%, but to then see cuts in the second half of 2023. This reflects a disconnect with the Fed’s projections. Which scenario plays out will depend on the path of inflation and in turn will be a major driver of how stock and bond markets perform.

Investors are expecting the Fed to need to cut the fed funds rate as many are expecting a recession in 2023. Economic news has generally pointed to a slowing economy with home prices and sales falling, and consumer spending down. However, employment remains strong with hiring above estimates and the unemployment rate still below 4%. The yield curve has inverted, meaning longer term interest rates are lower than shorter term interest rates, which has preceded recessions historically. In addition, public comments from many corporate executives have offered pessimistic outlooks about the near term. The possibility of a recession is also a reason why we’ve seen stocks pull back over the past year. Economists’ expectations are for a relatively mild recession, but that can certainly change. Investors will be paying close attention to future economic releases as well as comments and actions by the Fed for insight into the future direction of the economy.

In Europe, inflation and recession fears have climbed as well with the Russia/Ukraine conflict amplifying the issue. Eurozone inflation has eased recently, but inflation in the Eurozone and UK remains near multi-decade highs. Given the high level of inflation, central banks have moved their policies to be much more restrictive. The Bank of England has made large benchmark rate increases and expects a recession in the UK through the end of this year. The European Central Bank (ECB) is moving aggressively to raise its benchmark rate, and ECB chief Lagarde has said a recession is likely. The war in Ukraine has added to the inflation problem by driving up energy prices. In addition, the threat exists for the war to pull in other major global powers, which would have a severe impact on global stock markets. China’s zero Covid policy significantly weighed on GDP growth in 2022, as the 3.0% growth rate was the second lowest since 1976, but the country has taken steps to relax Covid restrictions. The changes could help speed economic growth and improve global supply chains with economists projecting improved growth in 2023. Investors will be keeping a close eye on the Russia/Ukraine conflict and any changes in central bank policy around the globe for their impacts on financial markets.

With the House retaken by Republicans at the midterms and the Senate in Democrat control, the second half of the Biden administration is headed for a divided government. While this limits the likelihood of any substantial changes in legislation over the next two years it does not mean that investors will be without political issues to consider. The Federal government has reached its borrowing limit and now will need to take “extraordinary measures” to meet its most important financial obligations. Without increasing the debt limit, the federal government has the potential to default on its debt in late spring which would likely have very negative consequences on financial markets. We have been down this road before. The political brinkmanship is liable to go to the 11th hour raising investor anxiety. While a deal will most likely be reached, as seen in the 2011 standoff, it could negatively impact the county’s credit rating or cause a stock market pullback.

After surging in 2021, corporate earnings cooled in 2022. Analysts estimate that earnings fell in the 4th quarter for the first time in over 2 years with a projected decline of 3.9% for S&P 500 companies. The projected drop is due to high inflation, climbing interest rates, and weakening economic growth. For 2023, estimates are for an earnings growth rate of 5.3%, a slight increase over 2022. The impact that inflation and the weakened economy have on businesses will have a significant effect on operating results, and in turn, stock performance in 2023.

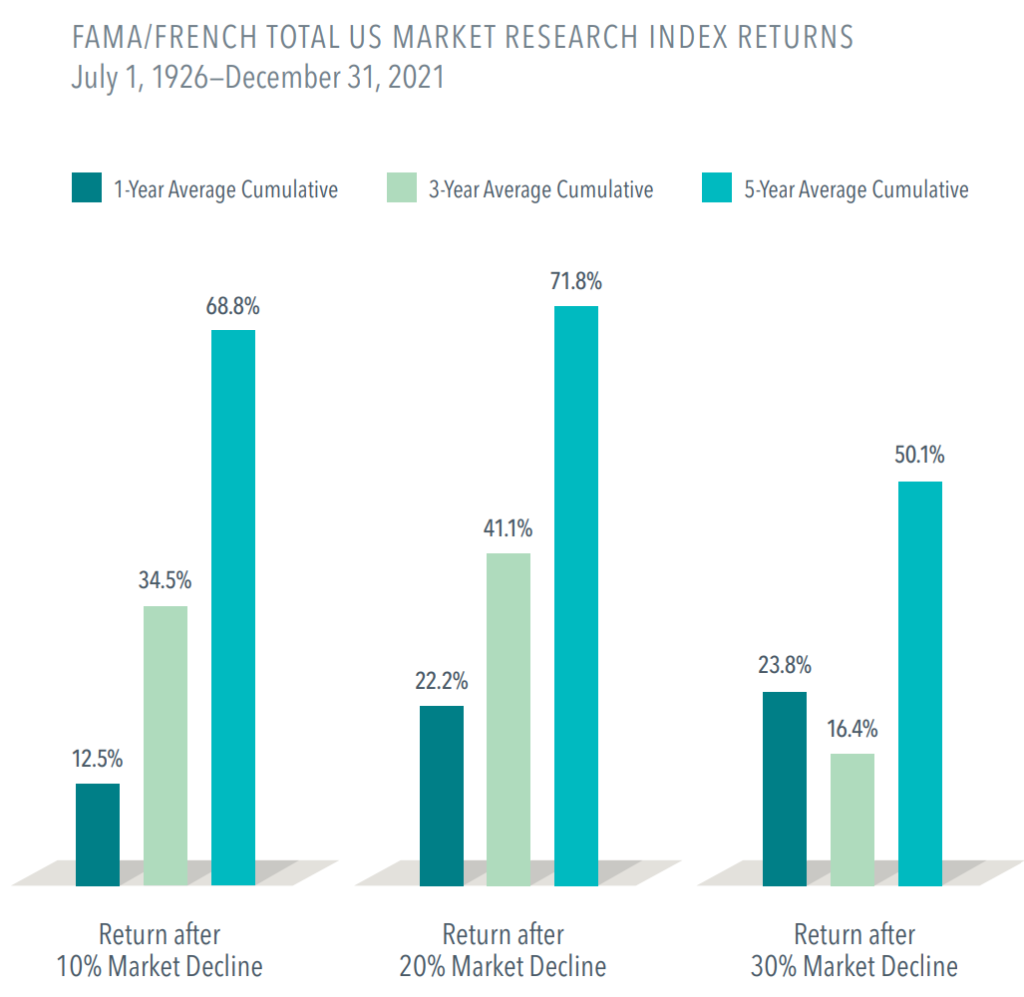

While many are issues clouding the market outlook, I think it is important to remember that there will always be risks for investors to consider. Investors continue to invest as they believe they will be compensated for these risks over time. As we can see in the below chart, investors have been rewarded for remaining invested historically. It depicts the cumulative total US stock market performance one, three, and five years after large declines. The average returns after those down periods have been very strong.

While we hope 2023 is a better year for investors, considering the risks outlined above its quite possible that 2023 is just as volatile as last year. However, we remain confident in the long-term return potential offered by the stock market. On the bond side, 2023 is starting off in a much better position with much higher expected returns than where we were a year ago. We believe those investors who are able to tune out the noise and stay disciplined to their investment strategy will best position themselves to meet their investing goals.

1 US Stocks are represented by the Russell 3000 Index.

2 Bonds are represented by the BBgBarc US Intermediate Government/Credit Bond Index.

DISCLOSURES

CPI information sourced from www.bls.gov.