The latest thoughts on investment strategy and the markets, plus tools and templates from Raffa’s portfolio management team to empower nonprofits and associations to make better informed investment decisions.

- All

- Advisor Alerts

- Economic Insight

- Monthly Commentary

- News

- Nonprofit Investing

- Personal Financial Management

- Portfolio Strategy

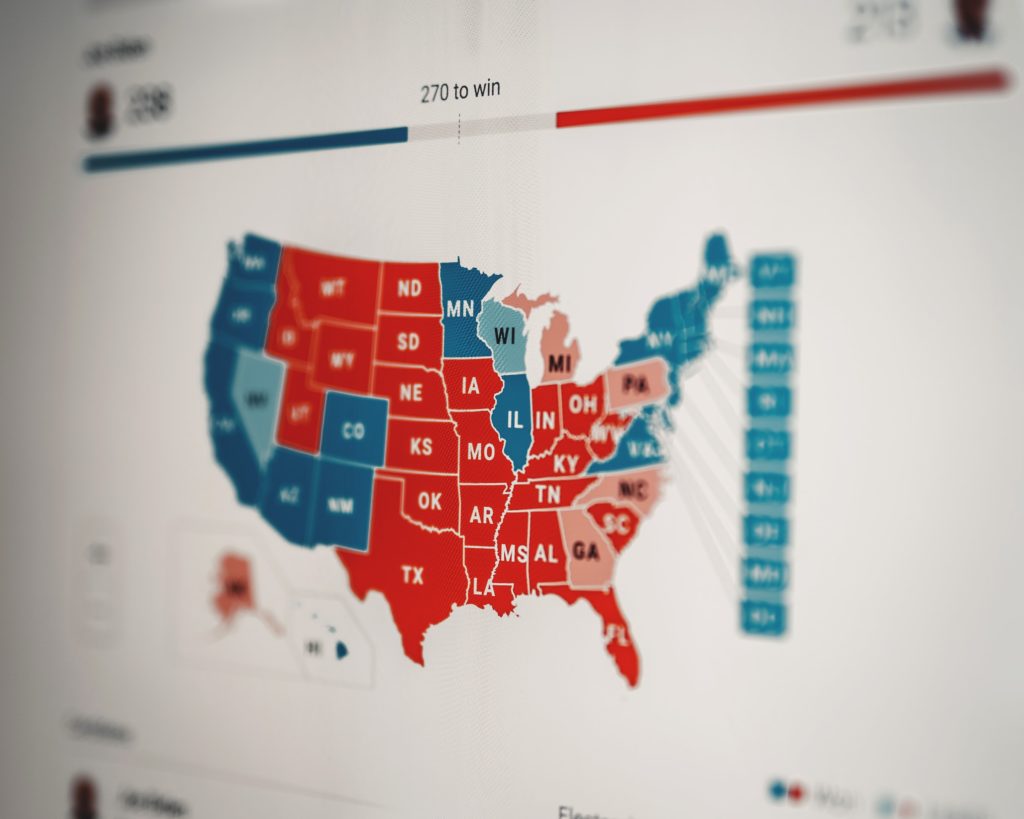

US stocks surged in November following a conclusive presidential election result with Republicans taking control of the White House and…

A five-month streak of strong gains in the US stock market came to an end in October as stocks declined…

A very strong third quarter came to a close in the wake of the Federal Reserve (Fed) lowering interest rates…

Market volatility during presidential elections can create both risks and opportunities for nonprofits and associations. It’s essential to make sure…

Overall, both stocks and bonds performed well in August and have performed well so far this year. As we head…

There are many factors that drive the performance of the markets throughout the year: corporate earnings, economic news, central bank…

The third quarter is underway and commenced with fixed income having a stellar month on the expectation that the Federal…

What nonprofits and associations need to know about performance, fees and investment oversight Values-based investing has benefitted investors by allowing…

The second quarter came to a close with US stocks continuing their positive run and gaining over the month despite…

Values-based investing — like socially responsible investing (SRI) and Environmental, Social, and Governance (ESG) investing — has gained significant traction…

May ended on a much better note than April, with both stocks and bonds rebounding nicely over the month. Domestically,…

April was a challenging month for both stocks and bonds as US stocks posted their first monthly loss since October…

Raffa takes a deeper look at how a handful of technology stocks have come to dominate the US stock market…

March kicked off with a strong jobs report followed by data showing that inflation was still sitting above the Federal…

US Stocks led the way through February with several indices crossing all-time highs throughout the month. Corporate earnings season has…

2024 is underway, and the New Year kicked off to a turbulent start as stocks stumbled out of the gates…

December was a great month for the markets, building on the gains of the previous month and capping off a…

Ryan Frydenlund sat down with Dennis Gogarty and Mark Murphy to recap the year for nonprofit & association investors and…

Markets closed on a positive note in November with signals of the US economy cooling off and reduced inflation lifting…

The first quarter of 2022 saw both stock and bond markets fall, which is an unusual event that we thought…

Last week certainly felt like a rollercoaster as news outlets waited until Saturday morning to declare Joe Biden as the…

With the increase in interest rates start the year and the relatively low yields offered by bonds, some investors are…

With the 10 year Treasury yield hitting 3% in April during a steady increase in interest rates to start 2018,…

With the first interest rate hike in more than nine years on the horizon revisiting some common misconceptions about fixed…

The unrest in Ukraine, the ouster of the country’s Prime Minister and the subsequent invasion by Russia into the Crimean…

By Jim Parker Trying to correctly time your entry point to the market is never easy. Just ask the experts….

Over the month of August you likely saw headlines about the European debt crisis and economic slowdown, China’s weakening growth,…

The ‘fiscal cliff’ dominated the news in November and will likely continue to rule the airwaves, newspapers and internet through…

Over the month of August you likely saw headlines about the European debt crisis and economic slowdown, China’s weakening growth,…

We at Raffa Wealth Management preach investment diversification. By diversifying your investment portfolio broadly and efficiently it helps reduce portfolio…

The following post is from Weston Wellington’s regular column, “Down to the Wire”. Weston’s thoroughly researched views and clever style…

Interest rates around the world are at historic lows. They can only go in one direction from here, right? And…

Stock prices sank sharply on Monday in the wake of Lehman Brothers’ bankruptcy announcement over the weekend. Other firms perceived…

Summary The Department of Labor (DOL) has issued two new regulations aimed at empowering qualified retirement plan sponsors and participants…

A month and a half has passed since the U.S. hit the debt ceiling in May and an agreement still…

US stocks have jumped over the first 8 months of the year with the Russell 3000 Index rising 18.0%[1]. International…

Given the recent collapse of Silicon Valley Bank and Signature Bank and concern about additional bank failures, many nonprofits are…

It was a very difficult year for all investors. What does 2023 have in store?

If you’ve felt like stock prices were a little more volatile in 2022 than in recent years, your “spidey senses”…

The Internal Revenue Service (IRS) has released new limits for certain retirement accounts for the coming year. After months of…

From an investment standpoint, recent conditions have been something like a Halloween-themed hayride. Bumpy.. ok really bumpy, with a couple…

Inflation continues to be the biggest driver of market performance. Here are our thoughts.

Our team at RIA has had a fun-filled summer! We gathered our team from Denver, CO, Chicago, IL, and Atlanta,…

Given the significant current level of inflation and recent declines in stocks and bonds, how should an investor position their…